There is an English expression that best describes the cryptocurrency scene: “smoke and mirrors”. Cambridge Dictionary explains the expression as follows: “Something that is described as smoke and mirrors is intended to make you believe that something is being done or is true when it is not”.

In a way, the cryptocurrency industry is in the business of producing and selling hopes and dreams. The speculative value of the cryptocurrency scene is orders of magnitude (10000x or more) ahead of actual adoption. Most of the “buzz” surrounding cryptocurrency stems from speculation. Speculation is at the center of this movement. Speculation is the single root cause of why the cryptocurrency movement ever went mainstream and stopped being a hobby project for cypherpunks, crypto-anarchists, and other “basement dwellers” of the early community. Today, speculation is the core of the cryptocurrency movement and every project must respect this fact to succeed in gaining mainstream traction. Mainstream traction literally means “being popular among speculators”.

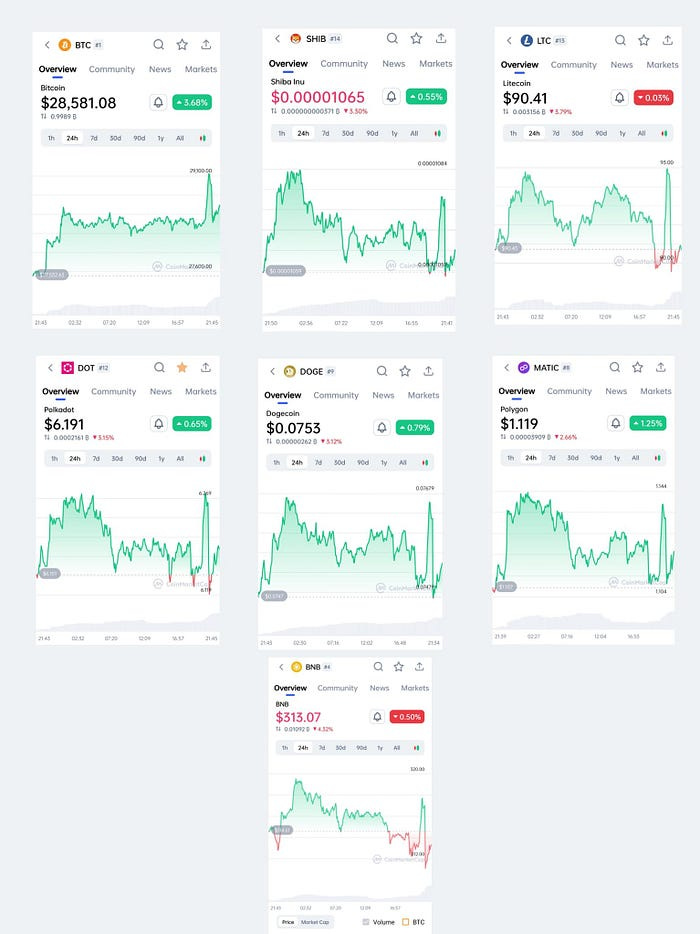

Speculating with cryptocurrency is highly attractive as volatility is high, and due to a lack of proper regulation, the scene is open to manipulation. This is readily exploited for profit by individual speculators, traders, and the companies involved with crypto. In the early days of cryptocurrency, infamous “pump and dump” schemes were rather public and the people behind them would openly brag about their success.

The same old methods were retained as the scene matured and became more “business” focused. They were just wrapped up in more “business-like” packaging. Today’s “projects” have CTOs, CEOs, CFOs, and other abbreviations usually found in the corporate environment. Today, the manipulators are not shadowy figures who hide behind Tor, but the very startups that issued the tokens and the whole industry of influencers, exchanges, market makers, and others. These groups hold even more control over the market than the pumpers of the past ever did. Today, control over the market is not only done by bluntly pumping the markets but also via targeted marketing and the shaping of public opinion.

What I am saying is that nothing has changed. Only the stakes became higher and thus the methods became more advanced and more organized.

Chapter 1. — Free Willy

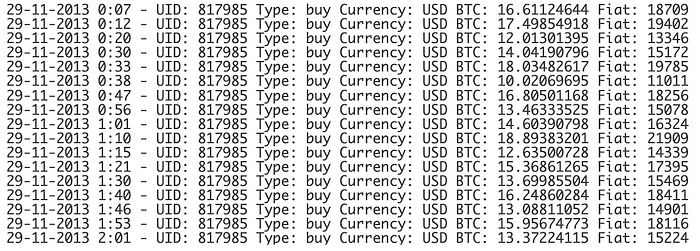

In 2013, the now-defunct Mt. Gox bitcoin exchange was allegedly hacked, resulting in the theft of approximately 850,000 bitcoins, which at the time was valued at around $450 million. However, prior to the hack, it was suspected that Mt. Gox had been manipulating the price of bitcoin on its exchange using a trading bot dubbed “Willy.”

Mt. Gox was closely related to the first Bitcoin speculative bubble, which occurred in late 2013. During 2013, the price of Bitcoin skyrocketed from around $13 per Bitcoin to over $1,000 per Bitcoin.

During this time, Mt. Gox was the largest Bitcoin exchange in the world and handled over 70% of all Bitcoin trading volume. People were flocking to Mt. Gox to trade the new and exciting bitcoin. Little did they know that Mt. Gox invited a friend to play along, a friend named Willy.

The Willy bot was used by Mt. Gox to purchase large amounts of bitcoin, which artificially inflated the price of the cryptocurrency on the exchange. This manipulation allowed Mt. Gox to attract more traders and investors, leading to a positive feedback loop that pushed the price of bitcoin higher and higher. The BTC-USD exchange rate jumped from around $150 to more than $1,000 in less than two months.

The consequences of the Willy bot manipulation were significant. Market manipulation created an unsustainable bubble that ultimately burst, leading to a sharp decline in bitcoin’s price. Furthermore, the loss of 850,000 bitcoins due to the hack of Mt. Gox dealt a severe blow to the confidence in the cryptocurrency market, and it took years for bitcoin to recover.

While the Mt. Gox story has been extensively researched, studied, and reported by professionals and amateurs alike, the story was largely forgotten by the general public by the time of the next bitcoin bubble in 2017. If you check recent headlines about Mt. Gox you will not find anything about market manipulation. The only news is the imminent danger of the Mt. Gox liquidator dumping bitcoins on the open market.

Perhaps retail has forgotten the lessons of Mt. Gox but the con artists, hustlers and crooks of this world sure did not. Valuable lessons were learned, specifically the effectiveness of wash trading. Fake it until you make it is the new motto of the entire scene.

Not just Bitcoin, and not just Mt. Gox. If the model works and is proven successeful, copycats will naturally follow.

Back in late 2016, or perhaps early 2017 I had a brief chat with a guy who had a role at the very core of the NEM project. This person reached out headhunting I believe. Among other things, he told me that they (NEM) had a meeting with BTC-e about opening markets on the said exchange.

At the time BTC-e was quite important on the scene. It was a dominant market for many first-generation coins like Litecoin, Namecoin, and Peercoin and was still rather important for BTC, but losing market influence to Bitfinex and BitMEX. Anyway, NEM refused the deal and decided not to have their markets at BTC-e. My source from NEM claimed that they were spooked by how open and direct about market manipulation the BTC-e operators were. My source told me that BTC-e had an office full of traders who were trading against their customers, boosting the volume and painting the charts.

Insiders and people with access to such information could likely corroborate similar “setups” at most of the cryptocurrency exchanges before the end of the second bubble. It likely continues today, as you read this.

Later in 2017 BTC-e was closed down, by the FBI nonetheless.

In late 2018 and early 2019, multiple sources wrote about the New York Attorney General’s office quest to figure out what was going on at Bitfinex. The claim was that Bitfinex had used its sister company Tether’s stablecoin to manipulate the price of bitcoin, by using Tether to purchase large amounts of the cryptocurrency and inflating the price.

Much like Mt. Gox in 2013, in 2017 Bitfinex created fake demand for bitcoin and helped orchestrate the second bitcoin bubble.

Thanks to Bitfinex and Tether, the SEC (of the USA) is officially considering Bitcoin to be a manipulated asset. In SEC ruling №34–94006, published January 20, 2022, SEC declines a bid for Bitcoin ETF stating the risk of: “manipulative activity involving the purported “stablecoin” Tether (USDT)” and fraud and manipulation at bitcoin trading platforms.

The most recent story about market activation on the industrial scale comes from Binance.

The CEO is direct or indirect owner of entities that have engaged in proprietary trading activity on the Binance platform,” and was likewise the “direct or indirect owner of approximately 300 separate Binance accounts” that engaged in prop trading on the Binance trading platform. — Coindesk

It takes effort to upkeep 300 accounts and engage the market from all of them. My guess is that all 300 accounts are automated through the API and algorithms and bots are doing the actual trading. Again, this is an industry-wide norm.

And again, not just Binance, but also other popular cryptocurrency exchanges, such as OKex, Huobi, and Bithumb, have been regularly accused of engaging in wash trading to make their trading volumes appear larger than they actually are. Said allegations have stated that up to 94% of trading volume at Bithumb is fake, and by the looks of the order books over there I believe this is a fair assessment.

By engaging in wash trading, these exchanges create the impression that their markets are more active and liquid than they are, which can attract new traders and generate more revenue for the exchange.

Wash trading is a form of market manipulation that involves artificially inflating trading volume in order to create a false impression of market demand.

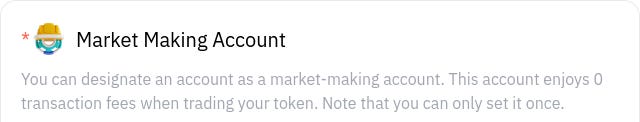

Exchanges know that you’ll be bringing your friend Willy along with you when you open the markets for your coin, that is why they will prepare one or two zero-fee accounts to be used by Willy. If you need more zero-fee accounts, just ask.

These exchanges may use various techniques to engage in wash trading, such as creating multiple accounts and trading between them, or using trading bots to execute trades automatically and constantly, leading to large numbers of trades that are not necessarily reflective of real market activity.

Crypto is the most manipulated market in recent history. In order to succeed, you must adopt the established methods. You start by opening markets with smaller exchanges, wash trade big time and you will build up the base for the big listing. Wash trade with the force of a thousand suns until you hit Binance and Coinbase. This is the way.

Summary for dummies: Step one is to get a friend named Willy.

Chapter 2. — Hire the Professionals

Perhaps you have noticed that crypto dances in unison. This is because almost everyone tends to hire the same market makers, who use the same bots and algos on the same exchanges for all of it. That is why it all looks the same and acts the same. At the very top, there is a very small group of people who run the whole show — a cartel. Your goal is to join this cartel.

Some of the most prominent market makers in the crypto space include Jump Trading (Jump Crypto), Jane Street, DRW Trading, DWF-labs, Wintermute, Cumberland Mining (DRW), and GSR. These firms use algorithmic trading strategies and high-frequency trading to provide liquidity and facilitate trading on cryptocurrency exchanges.

While your coin is young and trading on a handful of smaller exchanges, Willy’s help will suffice.

However, once you scale up and attract more audience you should seek professional help. Listing with big exchanges is the next step. They know the game, I mean they are the game, and they will help you out for mutual benefit. If your coin/token has a sellable narrative and sufficient trading volume you will be able to approach big exchanges and talk about listing.

By listing on a big exchange, you are paying for the privilege of using their user base as exit liquidity. The exchange knows this, and you know this. Everyone knows it. That is why big exchanges will want a “cut“. They know you are coming to their platform to cash out. This is called a “listing fee”, but recently for the sake of legal deniability it is called an “integration fee”. They will also demand the use of market makers in order to guarantee the appearance of an active and dynamic market with many participants. Fake it until you make it.

Market makers are important participants in financial markets that help to ensure that investors can buy and sell easily and efficiently.

A market maker is a financial institution that helps buyers and sellers trade securities in a financial market. They make it easy for people to buy and sell by buying and selling securities at publicly quoted prices. They play a vital role in keeping the markets running smoothly.

There are market makers in crypto as well, but they tend to have a more “hands-on” approach. Crypto exchanges will require you by contract to hire a market maker. They will also demand that you guarantee some minimal daily volume. The inability to sustain minimal daily volume and liquidity expectations will result in delisting from the exchange. The bigger the exchange, the bigger the demands. In essence, you are obliged to wash trade or hire someone to do the wash trading for you, preferably both for maximum effect.

Market makers cost money, as they charge for their services. Their operation will cost you anywhere between $2k and $500k a month, depending on the size and scope of the operation. A small shitcoin that has just been listed on a couple of small exchanges will probably need $5–10k a month toward a market maker, and big operators like Ripple Inc. are likely spending $400k or more monthly on such services. Another thing to keep in mind is that market makers will trade with your money. You’ll give them both buying power (USD, USDT, USDC, BTC, ETH, BNB, or else) and a bag of your shitcoins, and they will trade with it. It is not uncommon for big exchanges to request up to half of the total token supply as a downpayment so they can pass it on to their market makers and bots. Crypto market makers will borrow your money and use it to “activate” the market.

This is where your presale money will come in handy. You can loan it to market makers and they can use it to push the price up and to provide the liquidity they need to shape the market. Pumps are the best and most cost-effective marketing in crypto. Pumps attract more eyes to the coin. More eyes on the coin, the more chance that your coin will get a cult following. It all comes together.

What you gain from hiring big-name market makers is the following:

You fulfill your contract obligations towards the exchange to sustain liquidity and volume,

You limit yourself from legal exposure, as the 3rd party is influencing the market in your name.

You officially join the cartel, business becomes easier now.

And finally, and most importantly — you get access to Tether, the central bank of crypto. Congrats, you are part of the family now.

Summary for dummies: If you want a task to be completed correctly, it’s best to employ experts.

Interlude 1. — Lonely up top

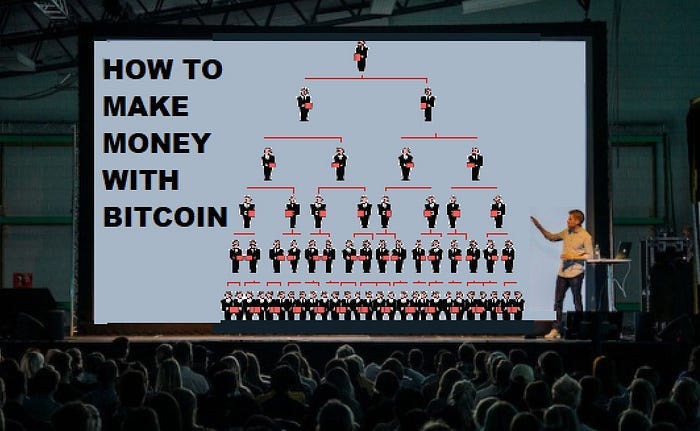

Crypto may seem like a never-ending ocean of people at first look, but the higher you climb up the pyramid - the fewer people you will find. At the very top of each popular token, there is but a handful of people, and at the top of the entire market, there are like two dozen people.

In the summer of 2020, Ethereum’s elder twin brother — Ethereum Classic suffered a 51% attack. This was the second 51% attack in the history of Ethereum Classic, and there was another one after this event.

This specific attack resulted in a massive reorganization of over 4k blocks and a successful double-spend of $1.68 million worth of ETC.

A 51% attack can have serious consequences for a cryptocurrency network, especially if it involves double spending. It undermines the integrity and security of the blockchain, and can lead to significant financial losses for individuals and businesses using the cryptocurrency. — Literally, ChatGPT

So if you ask a bot on the internet what are the consequences of a double spend attack, it will tell you how it is. So why did nothing happen? Why did nothing happen three times?

Rumor has it that at the time, the Kraken exchange took the bulk of the financial damages. Naturally, you will ask why is ETC still at Kraken. It is simple, someone simply took the bill and refunded Kraken. There is someone out there who bailed out an unsecured blockchain network three times, which means they have a significant financial interest in this specific token.

A blockchain network may as well not exist, as long as the token can have its price action. Sincerely, a lot of these tokens should probably be better off if they simply used SQLite.

After one crypto conference, back in 2019, my clients took me out for an informal dinner. We spoke crypto, of course, shitcoins, markets, trends, expectations of the coming cycles, and much more.

They knew that I am the project leader at Peercoin, and they got curious about how that works. Given that Peercoin did not have a fundraiser, an ICO, or anything of the sort, they asked how are you guys making money? Essential questions like that.

Anyway, to cut to the point, they asked who is “orchestrating” the Peercoin market. I answered that I don’t know and that I don’t think anyone is doing such a thing specifically. It looks organic to me. They were quite confused, and in response, they asked: “You guys in the Peercoin “team” are NOT orchestrating the market?”.

The conversation carried on and we touched on other cryptos of the first generation jokingly I asked who is orchestrating the Litecoin markets. A senior at the desk speaks up probably for the first time that evening. He speaks while waving his hand in a dismissing motion.

I know Litecoin, I know who it is. It’s just a few guys.

Every pyramid has a pointy end, and crypto pyramids tend to be especially pointy.

Chapter 3. — Reap what you sow

Getting on a big exchange will give you access to exit liquidity, and it will be fertile ground to grow a cult following. Hiring professional market makers will enable you to establish the base cash flow and keep the market alive. However, to sustain the cash flow you must influence the narrative in public space to invite more customers.

Influencing the narrative in the public space is done with the help of key opinion leaders, or simply “influencers”. Mostly Twitter, but also Reddit and to a lesser extent TikTok and similar abominations.

For starters, focus on Twitter. Crypto people call it “Crypto Twitter” or “CT” for short. They say “gm” to each other all the time, very easy to spot. Most of the popular accounts on “CT” are influencers and most of them are for sale. Just approach them and start discussing business. Ten, twenty bitcoins will go a long way. Hell, you can get L. Messi to tweet about your shitcoin for about $400k. These quotes are perhaps outdated now, as it’s been a while since I had access to such information.

Synergy of market maker operations and narrative shaping through key opinion leaders is mandatory in the current crypto environment if you want your project to be commercially successful.

You want to condition your community/followers to believe that the price moves up on positive news and the price moves down on negative news. Of course, this could not be further from the truth as the price is whatever you and your cartel of exchanges, market makers, and whales decide. However the average person, retail, must believe. In essence, your customer must believe you will “pump his bags”. This is the core concept of crypto-community bootstrapping.

Use the CT influencers to convince the crypto Joe that you (the founder) or the success of your company will pump his bags. Amplify the effect of influencers by deploying PR material to popular crypto news outlets. They will post whatever you want, for a fee.

One could state that the market is “bipolar” about the value of cryptocurrency, at the same time it gauges that it’s both worthless and priceless.

For this reason, it is necessary that the good news and marketing campaign is followed by a price increase. Price increases must be preempted by influencers explaining the reasoning on why the price has increased. Always have the influencers explain the reasoning for why the price has moved. Without explanation, the crypto Joes of this world will start doubting the price action.

Food chain

It is important to understand the crypto food chain. If you want your coin to sustain, it must form a healthy ecosystem. Everyone must eat. Starting a cult is of the utmost importance in securing a healthy ecosystem. Without a cult, many mouths will be left hungry, and this could turn into resentment towards you, and it could stop your future ventures. The cult will secure the food source for many years to come.

A food chain is a sequence of organisms in an ecosystem where each organism is the food source for the next organism in the chain. In a food chain, the energy and nutrients flow from one organism to another, starting from the primary producers and ending with the top predator.

In nature, krill are small crustaceans that form the basis of the world’s ocean food chain. In crypto, the word “krill” is used to describe small investors, traders, and speculators who are not professionally engaged with crypto trading. The majority of the crypto population falls into this group. People who fall into this group are only marginally involved in the scene and consider it a hobby This is why they usually don’t do their own research and only follow the trends and the influencers. Obviously, others feed on the krill, as krill are the base of the food chain. As a rule of thumb, krill will sell low and buy high. Occasionally they are “allowed” to win and this is what keeps them in the game. If the project has no krill around, it won’t have the dolphins or the whales, as they have nothing to feast upon.

Once the food chain is established, remember that there are mouths to feed. Exchanges must eat, market makers must eat, your partners — whales must eat, you must eat and your community must believe that they will eat.

Pavlov’s dogs

Reinforcement learning.

Reinforcement learning is like teaching a robot how to play a game. Imagine you have a robot and you want it to learn how to play a game. You show the robot how to play the game and give it a goal, like getting a high score. Every time the robot makes a good move, you give it a reward, like a treat. Every time it makes a bad move, you give it a punishment, like a timeout.

This is very relevant in crypto. The average Joe of your community is like the robot in the definition above. He is a blank sheet, an unrefined greed-driven creature. He only understands the emotions, the endorphin kick of a winning trade, and cortisol drenched trauma of the losing trade.

Reward him with a pump on “good news” and follow through with a dump on “bad news”. They learn quickly. Since we’re in 2023 and not in 2016, most of the market participants of crypto markets are already well-conditioned, and what you need to do is go with the flow. This is why it’s called an industry now, it’s industrialized. Ripple Inc. is one of the champions of the industry and they excel at this game.

Interlude 2. — Crypto markets are Very Malleable

Let me provide an example using something I’ve recently spotted on Twitter. It is about Ripple Inc. and its “utility token”. They are recently doing some rather impressive “orchestrations”.

Since we’re in 2023 and not in 2016, most of the market participants of crypto markets are already well-conditioned, and what you need to do is go with the flow. This is why it’s called an industry now, it’s industrialized. Ripple Inc. is one of the champions of the industry and they excel at this game.

Pumps are the best marketing in crypto, but they must be followed up with good news, or preempted with “reasoning” through PR articles and Twitter influencers.

For example, a series of articles are released over the course of a week, articles that suggest the price of XRP is bound to go up if Ripple Inc. does well in the courtroom. Then the market maker starts moving the price up and Joe reasons that it must be because Ripple Inc. is doing well in the court.

Another recent example came from the world’s favorite “memecoin”. Dogecoin.

On April 4th, 2023, Elon Musk changed the Twitter logo — Bluebird to a picture of an anime dog. The price of DOGE increased by ~30% in a very short time. On Apr 7, Musk changed the Doge logo back to Bluebird, and the price of DOGE decreased by ~6%. During this period, two whales among the top five holders of Dogecoin reduced their holdings by ~1.4B DOGE, worth $121M at the time.

The lesson here is that it is easy to create exit liquidity at a moment’s notice.

Crypto Joe loves speculating on how some piece of news or future event will influence the price ticker and he loves being right about it. Crypto Joe has a rather shallow understanding of both the underlying technology, finance in general, and the sheer nature of the trading game and needs third parties like influencers to interpret the new and exciting technologies or latest events for him. Due to this, Crypto Joe will subscribe to various theories and information floating around in the community and try to extrapolate it to predict the future.

To influence the narrative, employ influencers and key opinion leaders who will present an understandable narrative for the average Joe.

Crypto Joe:

If these smart people believe in this, I should believe it too.

Cultism

Cults actually happen organically, you will just need to push it. People spontaneously form groups and communities. Use this to your advantage.

Use the potent combination of strategic price action which reinforces the emotional response to news and events happening around the project and the charisma of key opinion leaders.

Cult-like behavior, refers to a set of practices, beliefs, or behaviors associated with an organized group or movement that exhibits extreme or deviant behavior, often characterized by strong loyalty to a leader or ideology, and a tendency to isolate from mainstream society. Cultism can involve manipulation, control, and exploitation of its members, and may exhibit characteristics such as a hierarchical structure, rigid dogma, psychological manipulation, and harmful or illegal activities.

The most obvious and probably the most successful example of a crypto cult is of course the bitcoin cult. Every subsequent crypto cult is simply trying to emulate the success story.

Bitcoin’s price history can be compared to the biblical legend of Lazarus in that it has been resurrected multiple times after experiencing sharp declines. Despite all the controversies, Bitcoin’s price has managed to bounce back time and time again, creating a strong cult following around the cryptocurrency.

The bitcoin model shows how it’s done. The essence is that price must bounce back up. People must keep dreaming that one day they will make it. Convince them that the promised land is just around the corner, it is happening any day now — you better not miss it. Deflect the FUD by pumping, and have the influencers write kilobytes of apologetic text whenever something negative happens. Shower the masses with whataboutism, and respond to every single criticism with passion.

Once established, the cult will be a long-term source of food for everyone involved. This community will be the people who will buy the dips, allowing the scheme organizers to restart the cycle. They will buy the tops and sell the bottoms. They will provide liquidity and trading volumes. And most importantly, they will invite newcomers to the scheme.

Summary for dummies: Final step is to start a cult.

Disclaimer

The text above is provided for informational purposes only and should not be construed as legal advice, investment advice, or any other professional advice. The information presented here is not intended to substitute for professional advice and should not be relied upon as such. No representations or warranties of any kind, express or implied, are made about the completeness, accuracy, reliability, suitability, or availability of the information contained in this text. Any reliance on the information provided in this text is strictly at your own risk. Always seek the advice of a qualified professional before making any legal, financial, or investment decisions.